This renewal levy funds staffing

Vote YES for Vancouver Public Schools

We're volunteers in Vancouver, Washington who advocate for local bonds and levies that benefit schools. We believe that investing in children is a community responsibility. Good schools sustain the social and economic health of our area. We all need them to thrive.

Maybe you went to public school. It's possible your children go to one, or they graduated from one. Perhaps you work in a public school or live near one. You definitely know that great public schools are essential to thriving communities in a strong nation.

Whatever your reason for supporting them, we're all in this together!

- Vancouver Public schools will run a replacement technology, safety and security levy in February to replace the current technology levy that expires at the end of 2025.

Scroll down to read more

This is not a new tax, it will help to continue funding:

- Technology: replace and maintain future-ready digital tools and infrastructure that prepare students for modern learning and career opportunities. Things such as software that becomes obsolete or devices that are no longer supported by the manufacturer or become incompatible with modern software

- Safety improvements: like secure entrances and updated safety systems

- Building system repairs: repair breakages as they appear to extend the life of existing facilities (e.g., HVAC, roof leaks).

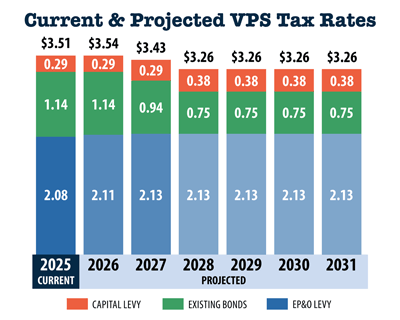

The levy rates proposed were designed with the intent to keep VPS-related levy rates flat over time. Delaying some technology and safety projects in an effort to do so.

The estimated levy rates* are:

- $0.29 per $1,000 of assessed property value in 2026.

- $0.36 per $1,000 in 2027.

- $0.38 per $1,000 from 2028 through 2031.

Tax rates from previously approved bonds are expected to decrease in the future, meaning the total VPS tax rates are intended to remain consistent over time.

*Future tax rates are estimates and fluctuate due to changes in property assessments and area growth.